The Credit For Nonbusiness Energy Property Was Extended Until . the credit rate for property placed in service in 2022 through 2032 is 30%. Energy efficient home improvement credit. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. As amended by the ira,. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. the consolidated appropriations act, 2018 extended the credit through december 2017.

from blog.constellation.com

let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. the consolidated appropriations act, 2018 extended the credit through december 2017. As amended by the ira,. Energy efficient home improvement credit. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. the credit rate for property placed in service in 2022 through 2032 is 30%. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and.

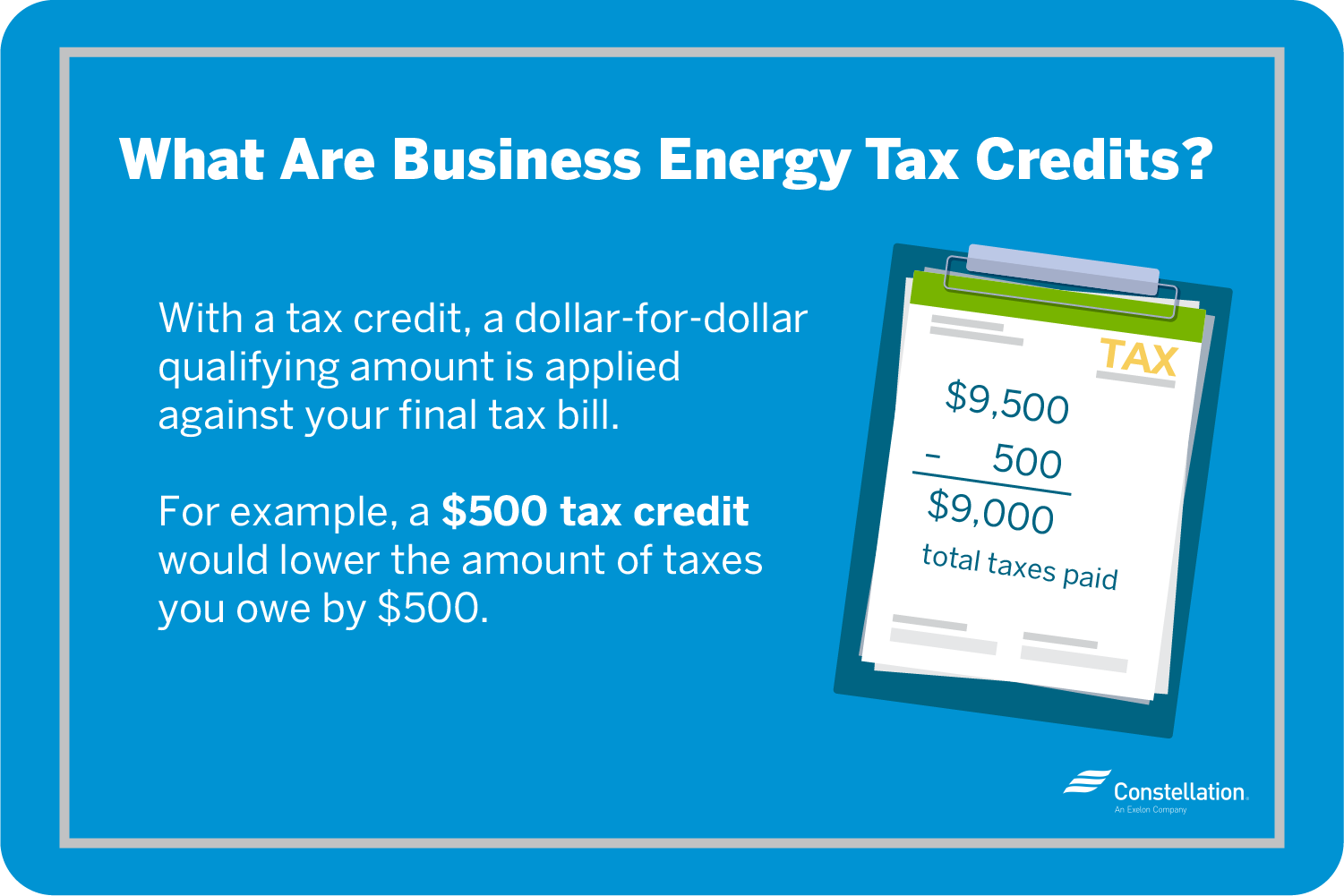

Finding Small Business Energy Tax Credits Constellation

The Credit For Nonbusiness Energy Property Was Extended Until the credit rate for property placed in service in 2022 through 2032 is 30%. the consolidated appropriations act, 2018 extended the credit through december 2017. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. As amended by the ira,. Energy efficient home improvement credit. the credit rate for property placed in service in 2022 through 2032 is 30%. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits.

From www.lindstromair.com

Spring Into Action The Energy Property Tax Credit Has Been Extended The Credit For Nonbusiness Energy Property Was Extended Until Energy efficient home improvement credit. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded. The Credit For Nonbusiness Energy Property Was Extended Until.

From slideplayer.com

Copyright © 2013 Pearson Education, Inc. publishing as Prentice Hall The Credit For Nonbusiness Energy Property Was Extended Until the consolidated appropriations act, 2018 extended the credit through december 2017. Energy efficient home improvement credit. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. through december. The Credit For Nonbusiness Energy Property Was Extended Until.

From efficientwindows.org

Extended Tax Credits for EnergyEfficient Windows Efficient Windows The Credit For Nonbusiness Energy Property Was Extended Until Energy efficient home improvement credit. the credit rate for property placed in service in 2022 through 2032 is 30%. As amended by the ira,. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. through december 31, 2022, the energy efficient home improvement credit is a. The Credit For Nonbusiness Energy Property Was Extended Until.

From slideplayer.com

As of Nov 2017 Subject to change… ppt download The Credit For Nonbusiness Energy Property Was Extended Until As amended by the ira,. Energy efficient home improvement credit. the consolidated appropriations act, 2018 extended the credit through december 2017. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. the credit rate for property placed in service in 2022 through 2032 is 30%. for qualifying property placed in service. The Credit For Nonbusiness Energy Property Was Extended Until.

From cebebadi.blob.core.windows.net

Improvements Qualifies For The Nonbusiness Energy Credit In 2021 at The Credit For Nonbusiness Energy Property Was Extended Until As amended by the ira,. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. the credit rate for property placed in service in 2022 through 2032 is 30%. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. Energy efficient. The Credit For Nonbusiness Energy Property Was Extended Until.

From blog.constellation.com

Finding Small Business Energy Tax Credits Constellation The Credit For Nonbusiness Energy Property Was Extended Until for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. As amended by the ira,. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. the consolidated appropriations act, 2018 extended the credit through december 2017. Energy efficient home improvement credit. the credit rate. The Credit For Nonbusiness Energy Property Was Extended Until.

From gopaschal.com

25C Residential Energy Efficiency Tax Credit Paschal Air, Plumbing The Credit For Nonbusiness Energy Property Was Extended Until As amended by the ira,. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property. The Credit For Nonbusiness Energy Property Was Extended Until.

From jackeesuperstar.blogspot.com

Nonbusiness Energy Credit Form The Credit For Nonbusiness Energy Property Was Extended Until the credit rate for property placed in service in 2022 through 2032 is 30%. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. As amended by the ira,. the. The Credit For Nonbusiness Energy Property Was Extended Until.

From eyeonhousing.org

Use of Residential Energy Tax Credits Increases Eye On Housing The Credit For Nonbusiness Energy Property Was Extended Until let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. the consolidated appropriations act, 2018 extended the credit through december 2017. As amended by the ira,. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. the credit. The Credit For Nonbusiness Energy Property Was Extended Until.

From studylib.net

Residential Energy Credits The Credit For Nonbusiness Energy Property Was Extended Until the credit rate for property placed in service in 2022 through 2032 is 30%. Energy efficient home improvement credit. the consolidated appropriations act, 2018 extended the credit through december 2017. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. As amended by the ira,. for qualifying property placed in service. The Credit For Nonbusiness Energy Property Was Extended Until.

From www.scribd.com

Residential Energy Credits Instructions for Claiming the Residential The Credit For Nonbusiness Energy Property Was Extended Until the credit rate for property placed in service in 2022 through 2032 is 30%. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. for qualifying property placed in service. The Credit For Nonbusiness Energy Property Was Extended Until.

From jackeesuperstar.blogspot.com

Nonbusiness Energy Credit Form Armando Friend's Template The Credit For Nonbusiness Energy Property Was Extended Until Energy efficient home improvement credit. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. the credit rate for property placed in service in 2022 through 2032 is 30%. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. As amended by the ira,. . The Credit For Nonbusiness Energy Property Was Extended Until.

From fabalabse.com

What is energy property credit? Leia aqui What qualifies for energy The Credit For Nonbusiness Energy Property Was Extended Until for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. Energy efficient home improvement credit. the credit rate for property placed in service in 2022 through 2032 is 30%. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. As amended by the ira,. . The Credit For Nonbusiness Energy Property Was Extended Until.

From cebebadi.blob.core.windows.net

Improvements Qualifies For The Nonbusiness Energy Credit In 2021 at The Credit For Nonbusiness Energy Property Was Extended Until the consolidated appropriations act, 2018 extended the credit through december 2017. the credit rate for property placed in service in 2022 through 2032 is 30%. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. Energy efficient home improvement credit. As amended by the ira,. let’s take a look. The Credit For Nonbusiness Energy Property Was Extended Until.

From www.slideserve.com

PPT Review PowerPoint Presentation, free download ID5367623 The Credit For Nonbusiness Energy Property Was Extended Until for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. Energy efficient home improvement credit. the consolidated appropriations act, 2018 extended the credit through december 2017. the credit rate for property placed in service in 2022 through 2032 is 30%. let’s take a look at four key provisions within. The Credit For Nonbusiness Energy Property Was Extended Until.

From www.dreamstime.com

Conceptual Business Illustration with the Words Nonbusiness Energy The Credit For Nonbusiness Energy Property Was Extended Until As amended by the ira,. Energy efficient home improvement credit. through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. the credit rate for property placed in service in 2022 through. The Credit For Nonbusiness Energy Property Was Extended Until.

From www.slideserve.com

PPT Tax Credits (Lines 47 through 55 and Line 66, Form 1040 The Credit For Nonbusiness Energy Property Was Extended Until let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. the credit rate for property placed in service in 2022 through 2032 is 30%. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. As amended by the ira,.. The Credit For Nonbusiness Energy Property Was Extended Until.

From slidetodoc.com

Residential Energy Credits Extension modification of credit Nonbusiness The Credit For Nonbusiness Energy Property Was Extended Until let’s take a look at four key provisions within the inflation reduction act that relate specifically to energy efficient property credits. As amended by the ira,. for qualifying property placed in service after 2022, the nonbusiness energy property credit has been expanded and. Energy efficient home improvement credit. the credit rate for property placed in service in. The Credit For Nonbusiness Energy Property Was Extended Until.